6 important ways the mini-Budget (and the events that followed) could affect you

On Friday 23 September 2022, former chancellor Kwasi Kwarteng delivered an emergency “mini-Budget” following the election of prime minister Liz Truss.

The measures laid out in this mini-Budget would affect many areas of your finances, from the amount of tax you could pay, to how much it might cost to buy your next home.

After a year of economic volatility, including inflation reaching a 40-year high and the Bank of England (BoE) implementing seven consecutive base rate rises, Kwarteng announced a series of measures that aimed to help the UK “reach a trend rate of growth of 2.5%”.

However, since the announcement, Kwarteng was sacked and replaced by Jeremy Hunt. Subsequently, many of the policies laid out in the mini-Budget have been reversed by the new chancellor.

If you feel confused by the mini-Budget announcement and the decisions that followed, you aren’t alone!

Here are six key takeaways from the autumn mini-Budget and the decisions that followed.

1. The former chancellor made two cuts to Income Tax, both of which have been reversed since

In an unprecedented change to Income Tax rules, Kwarteng cut both the lowest and highest tax rates in his speech.

Addressing parliament, Kwarteng stated: “To raise living standards for all, we need to be unapologetic about growing our economy. Cutting tax is crucial to this.”

The former chancellor brought forward Rishi Sunak’s plan to cut basic-rate Income Tax by 1p, a move that was later reversed by Hunt

As of 6 April 2023, the basic rate of Income Tax was set to be reduced from 20% to 19%. This move was reversed by Jeremy Hunt in a “snap statement” on 17 October, who said basic rate Income Tax will remain at 20% “indefinitely”.

Kwarteng abolished the additional-rate tax band, then reversed his decision

In his announcement, Kwarteng abolished the 45% additional rate of tax, currently levied on those earning more than £150,000 a year.

However, after both political and market backlash, the former chancellor performed a U-turn. Speaking to the BBC, Kwarteng said the uproar surrounding the policy was “drowning out a strong package”, and claims he and prime minister Liz Truss decided to reverse the move “together”.

So, as it stands, all three tax rates will remain as they are for the 2023/24 tax year.

2. Kwarteng cut Stamp Duty for all homebuyers

One immediate change, coming into effect the day after the announcement, was Kwarteng’s cut to Stamp Duty.

Anyone buying their main residence will only pay Stamp Duty on amounts more than £250,000, unless you are a first-time buyer.

Previously, homebuyers paid Stamp Duty on homes worth more than £125,000, unless the property was their first home. First-time buyers paid Stamp Duty on any amount exceeding £300,000.

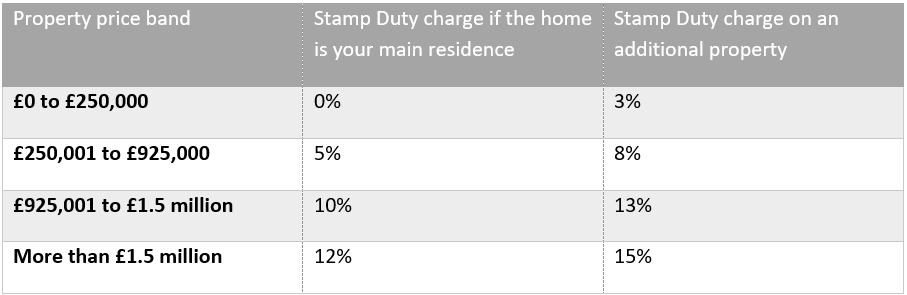

Now, the rules have changed. The below table shows the new Stamp Duty rates for all homebuyers except first-time buyers.

Source: HMRC

What’s more, first-time buyers will not pay Stamp Duty up to £425,000, and will pay a 5% rate on the portion between £425,001 and £625,000. Any amount above £625,000 is taxed at the usual rate.

So, if you are buying a home in the near future, you will likely pay less Stamp Duty than you would have before 24 September 2022. It could be wise to discuss how to make the most of this change with your financial adviser.

3. The planned Dividend Tax increase was scrapped by Kwarteng, then reinstated by Hunt

In another effort to decrease the tax burden for some earners, Kwarteng scrapped the 1.25 percentage point Dividend Tax rise that was set to come into effect in April 2023.

Based on Kwarteng’s decision, the ordinary, upper, and additional rates of Dividend Tax would decrease to 7.5%, 32.5%, and 38.1% (their 2021/22 levels) respectively on 6 April.

Yet, in another U-turn following Kwarteng’s announcement, new chancellor Jeremy Hunt reversed this decision, reinstating the planned 1.25 percentage point Dividend Tax increase.

So, from April, you will continue to pay Dividend Tax at 8.75%, 33.75%, and 39.35% respectively.

4. The 1.25% National Insurance increase was reversed by Kwarteng

In his 2022 spring statement, former chancellor Rishi Sunak raised National Insurance contributions (NICs) by 1.25 percentage points. In April 2023, a new Health and Social Care Levy was set to replace this rise.

Now, both have been reversed. You may be happy to read that, as of 6 November 2022, you will pay fewer NICs.

The BBC reports that this measure will save 28 million people an average of £330 a year. Plus, the government claims the reduction of NICs will help around 920,000 businesses save up to £10,000 a year.

So, if you are an employed person or a business owner, you could benefit substantially from this decision from November 2022 onwards.

5. The former chancellor scrapped the planned Corporation Tax rise – a move that was then reversed by Jeremy Hunt

In another reversal announced by Kwarteng in the mini-Budget, the proposed move to raise Corporation Tax from 19% to 25% in April 2023 was scrapped.

However, in his snap statement on 17 October, new chancellor Jeremy Hunt reversed this decision, confirming that “we will not proceed with the cut to Corporation Tax announced”.

So, if you are a business owner, you will see a 6% rise in Corporation Tax from 6 April 2023.

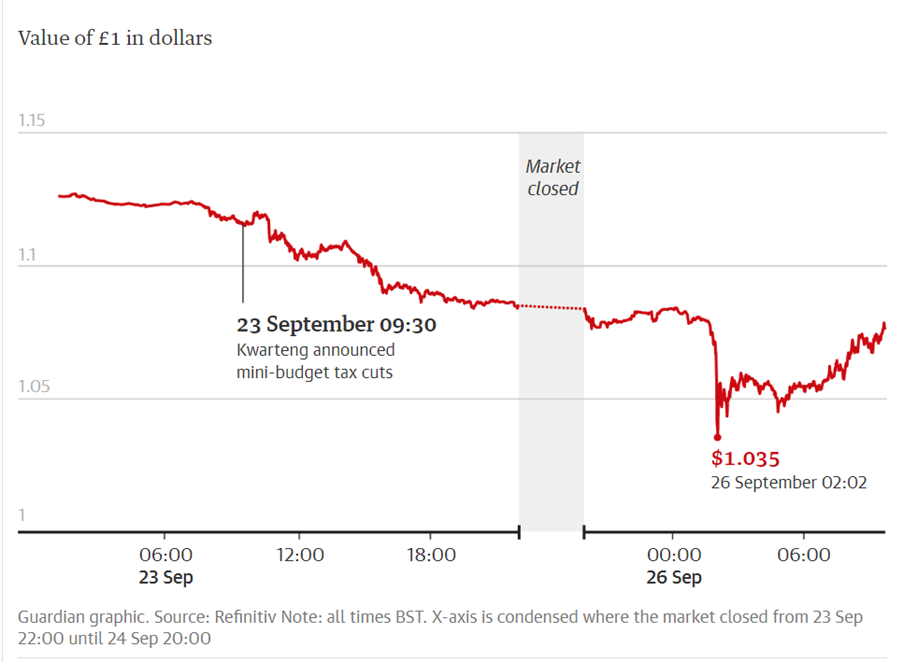

6. Kwarteng’s announcements had a significant effect on the value of the pound

After announcing a set of cuts that would reduce millions of earners’ tax liabilities, many investors responded by selling off British assets, resulting in sterling dropping to a record low against the US dollar.

The below table shows the value of the pound dipping in light of Kwarteng’s announcements, causing concern for individuals, business owners, and investors around the UK.

Source: the Guardian

Fortunately, the value of sterling has incrementally rebounded since Hunt’s appointment as chancellor, and the announcements that followed. As of Tuesday 18 October, sterling stood at $1.13.

If your investments have decreased in value this year, it is important to remain calm. Your Chancellor financial adviser can provide expert insights on market fluctuations and allow you to make informed decisions in the months and years ahead.

Get in touch

If you are concerned about how the former chancellor’s autumn mini-Budget and the events that followed might affect your finances, we can help. Email info@chancellorfinancial.co.uk, or call 01204 526 846 to speak to an adviser.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.